INVOX FINANCE

About INVOX Finance

The Invox Finance Platform is an invoice lending platform tapping into the US$2.8 trillion invoice financing industry.

Invox Finance Pty Ltd is a successful invoice financing company based in Indonesia, Australia.

Many businesses, especially small businesses, involved in the supply of

goods and services struggle to stay afloat due to cash-flow problems.

They are unable to meet day-to-day expenses and commitments as there is a

lack of cash being generated on a regular basis.

This refers to the invoice financing facility, where the investor advances to the seller against the bill issued as

“Invoice lending” or “invoice loan” or “lending”.

“Invoice lending” or “invoice loan” or “lending”.

System users

Investors are looking for higher returns and diversified investment portfolios.

Sellers that have invoices they want to sell to accelerate their cash flow.

Buyers who will receive an invoice payment period are renewed and rewarded for verifying the invoice.

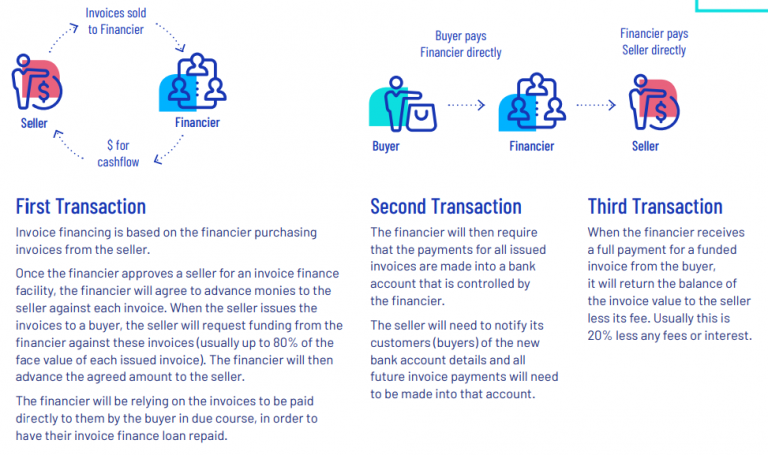

Traditional Invoicing Financing Works

Traditional Invoicing Financing Works

Other Financing Options for Sellers

- Peer-to-Peer

- Unsecured business loan from a non-banking financier

- Populous

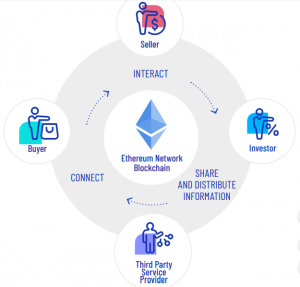

The Invox Finance Model

We

plan to disrupt and revolutionise the traditional invoice finance

industry by implementing a global distributed peer-to-peer lending

platform called the Invox Finance Platform. This platform will

completely eliminate the need for a financier’s involvement by

connecting businesses that wish to accelerate their cash-flow through

selling their invoices (“sellers”), directly with investors who wish to

finance these invoices.

Invox Finance’s differences

- Direct Access to Investors

- Lower Rates for Sellers

- A new way for Investors to Diversify

The Platform Overview

The Invox Financial Platform overview will consist of the following

- Dynamic Invoice Smart Contracts

- Loans Smart Contracts

- User Access and Processing Hub

- Bank API Integration

Use of Invox Token?

providing access to the platform through the Trusted Member Program

Award work is done for the platform. That is, the system

will reward buyers and sellers with Invox Tokens for invoices

verification, invoice payment and settlement.

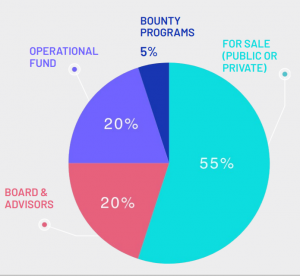

Token Allocation

Roadmap

Stage 1

The

Founders’ Investment Founded by the team from ABR Finance, we already

have six years of experience in the invoice financing industry. Through

ABR Finance, we have also created bespoke financing software for

traditional invoice financing, which has lead the founding team to

discover the limitations of centralised systems. The team will have

invested over $500,000 AUD in cash into Invox Finance. This investment

was used

to create an initial community, develop this white paper, conduct an ICO, establish a system framework,

and, most importantly, engineer the Dynamic Invoice Smart Contract. This Ledger facilitates the creation

and registration of invoices in a dynamic digital format to promote authenticity and transparency

for all parties involved and safeguard against data manipulation by any one party. This was the proof of

concept and the first step in creating Invox Finance Platform.

and, most importantly, engineer the Dynamic Invoice Smart Contract. This Ledger facilitates the creation

and registration of invoices in a dynamic digital format to promote authenticity and transparency

for all parties involved and safeguard against data manipulation by any one party. This was the proof of

concept and the first step in creating Invox Finance Platform.

Stage 2

Finalising the ICO and MVP The main objective will be to complete the ICO, and finalise the development of the

Minimum

Viable Product (MVP) . Once the MVP is complete, Invox Finance will run

a trial with ABR Finance as its first customer to demonstrate a use

case and commence rigorous user testing. This will allow for multiple

sellers and buyers to test the Invox Finance Platform with ABR Finance

as the investor.

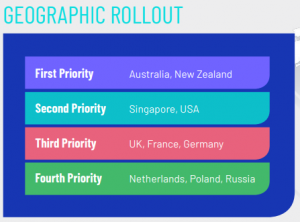

Stage 3

Goals

for use of ICO funds The first goal will be to fully develop the Invox

Finance Platform so that it can handle the scale necessary to meet the

goals detailed in this White Paper. Secondly, the team will roll out the

Invox

Finance Platform to the public. Following this, will be the creation of

a community around the Invox Finance Platform of investors, buyers and

sellers to ensure a substantial amount of users within the Invox

Finance

Platform. This will be achieved through marketing, grassroots

engagement, brand ambassadors and partners. The final goal will be to

engage and partner with other distributed platforms and other parties

who can bring extra value to the Invox Finance Platform.

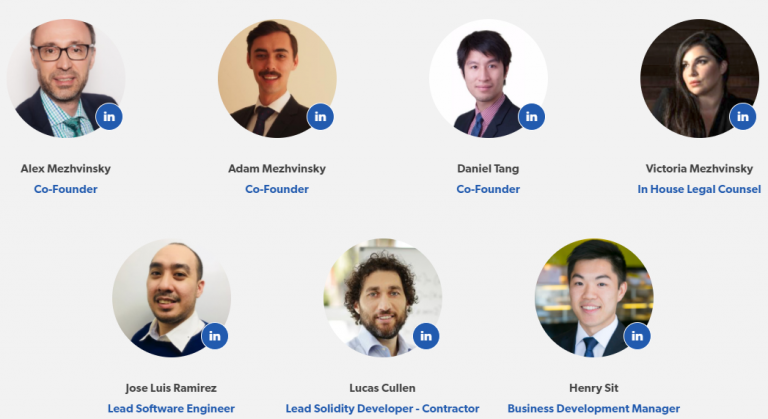

Team

For More Information, Please Visit the Website below :

Website: https://www.invoxfinance.io/

Twitter: https://twitter.com/InvoxFinance

Facebook: https://www.facebook.com/invoxfinance/

Medium: https://medium.com/@invox_finance

Instagram: https://www.instagram.com/invoxfinance/

Author : Endanglex

https://bitcointalk.org/index.php?action=profile;u=1743568

My ETH : 0x77FA8d2cC97975349F63E0ed1d4372B9865702A9

Komentar

Posting Komentar