VERNAM - The Future Of Insurance

VERNAM

The insurance industry is one of the largest and most important industries in the global market. But it is very rare that an insurance company using modern technology. Most companies still rely on the world’s largest insurance broker. This procedure involves High Commission fees and less transparent. Vernam has addressed this vulnerability in the insurance industry.

The Vernam Project is an honest

effort to revolutionize and digitize the insurance industry by

implementing high end technology solutions so as to minimize costs

associated with insurance services. For all intents and purposes, Vernam

initially targeted Europe.

One of the largest industries in the world is Insurance. By 2016, it's

worth $ 4.73 trillion. It now grows at a 3% CAGR. The size of the

insurance market in Europe, North America, and Asia is slightly

different. The premium amounts to $ 1.47 trillion, $ 1.46 trillion and $

1.49 trillion respectively. Despite the inclusion of personal device

connectivity, technology, AI and blockchain, the industry has not yet

witnessed a radical transformation in its operating business model. Of

course, there are positive outcomes such as cost savings, better

insurance experience, increased expectations, automation, and

personalization etc. That said, the business and operational landscape

has not changed in aspects like democracy, transparency, and efficiency.

They are the backbone of the current insurance industry that is getting

in the unwanted legislation and failing to claim compensation. They may

be one of the largest industries but the broker is the only entity in

this chain that gets the lion's share. A total of 30% premium policy

commissions are accepted by insurance agents and brokers. In addition,

the industry is still far from being adapted to current technological

advances that are similar to other business sectors.

Solutions Offered

VERNAM offers to build a market for various insurance products from

various companies based on blockchain technology. Under Smart Contract,

Insurance will be given to platform users. Because this platform works

for customers worldwide and there are different laws in each country,

they have created a worldwide Smart Insurance Contract registry for the

purpose of connecting different lists from different countries.

insurance requires risk management, Risk management is all about scoring

carefully, diligently managing and transferring risk intelligently.

Despite the emergence of various types of insurance, insurance

insurance, insurance, insurance, health insurance etc., the underlying

operating model for all insurance companies has become an element called

'premium'. For your information, the most dominant insurance in Central

and Eastern Europe is motor vehicle insurance. Since 2015, said

InsurTech to be a keyword. This is a mashup of two words - Insurance and

Technology. In the US, UK and Germany markets, investment in InsurTech

is on the rise.

Companies are banking on large data to create customized services and

insurance products. These companies are using AI to switch from

human-operated actions to fully automated routines. Thanks to smart

contracts and blockchain, efficiency and privacy are guaranteed. All

this is fine, but most of the insurance value chain is associated with

distribution. The main stakeholders in distribution are agents, brokers,

underwriters, and insurers. As a result, the entire insurance process

is getting slower and boring. And yes, a lot of money will be a margin

so leave a little money for the payment of claims.

The Vernam project is on an ambitious mission to change the insurance

system by eliminating intermediaries. Vernam Market solves the problem

and the Market is associated with a joint ledger that not only increases

transparency but also minimizes transaction costs, Data manipulation by

unauthorized parties is prevented.

Insurance agents and brokers will be part of networks created by

platforms in various countries. Optimizing the risks associated with

various insurance products, they are ready to revolutionize the

insurance industry. By Connecting a network of brokers and insurance

agents around the world with people, they create a platform that

everyone can trust. Their main focus is on crypto for crypto insurance

products that will revolutionize the Insurance sector.

Vernam uses blockchain technology to provide:

- Competitive online marketplace for conventional insurance products by the largest insurance companies.

- Generous compensation - up to 30% of the policy premium in Vernam token (VRN) is returned to the client.

- CryptoSafe "- a smart contract, ensuring that when a series of events is created, the client will be compensated with certain Vernam Tokens (VRNs), the newest and most innovative blockchain-based insurance product Vernam will introduce.

VRN Token (Vernam) (Ethereum-based standard token ERC20) is used to make

full use of this platform. Clients can purchase conventional insurance

through this market. They will receive the award in the same VRN token

as the broker's commission.

TOKEN ICO

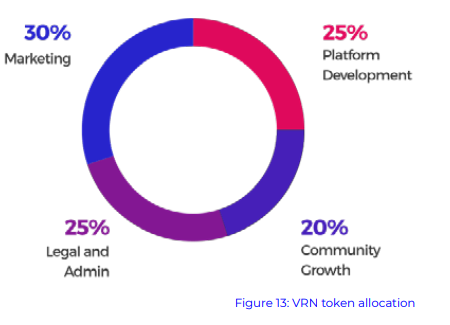

1,000,000,000 VRN Tokens are created for the project in which 50% will

be available for the ICO. 30% OF THE funds will be used in the marketing

of the platform while 25% of the funds will be used for the legal and

admin purposes.

30% of the token sale funds will be allocated to cover social platform

and other marketing channels, including website and content development,

the organization of events, etc. Legal and administrative fees will be

substantial, given the platform’s target of registering brokers in two

EU countries by Q2 2019 and covering 8 countries by the end of 2020.

Therefore 25% of the token sale funds will be directed to cover such

expenses..The remaining 20% will be used for network development.

Token

Start Of token crowdsale : April 2018

Overview

Token name : Vernam Token

Token symbol : VRN

Total VRN token amount : 1,000,000,000

VRN Hard Cap : 500,000,000 VRN

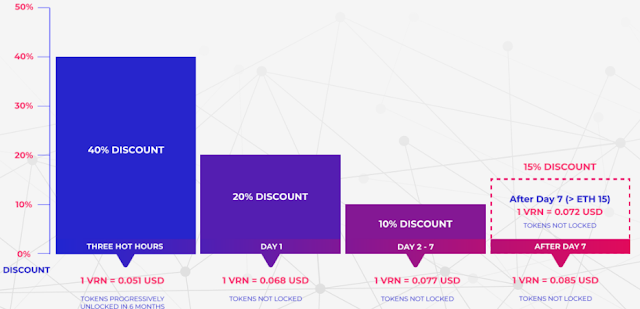

Conversion Rate : 1 VRN = 0.051–0.085 USD

Bonus Scale

TEAM

The team is very enthusiastic about developments in the insurance sector

with the introduction of their platform. They are open to collaborating

with like-minded people.

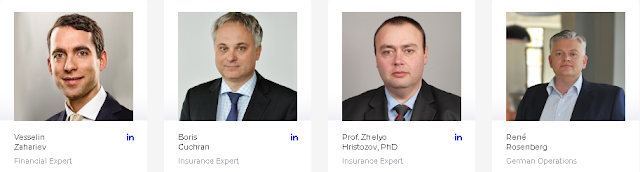

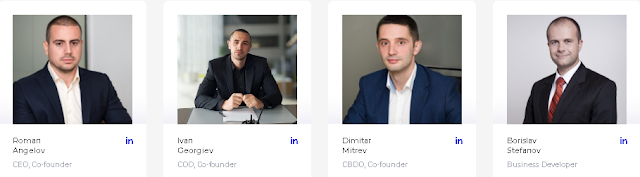

The vernam team consists of people with experience in the field of

insurance and blockchain technology, and has the support of an advisor

who will continue to provide input for Vernam's future development.

Conclusion

There are many insurance companies looking to cover everything that you

own. They are ready with their countless proposals to suit your needs

and they have been fairly successful which is quite evident from their

Market capitalization. The insurance industry is stable and successful.

They are an industry worth 4.73 trillion dollars. Perfect fit for every

situation in life, they have got you insured. The insurance market is

ripe for the revolution.They are planning to expand in the coming future

in the other countries of the European Union. While there are still

many hurdles in the realisation of full potential of the platform, they

are working hard to achieve the milestone.

Obtaining an insurance would be much easier when you have all the

information, and this platform aims to lead in the positive direction of

open information about the product. Standardizing the information and

procedures regarding the insurance for a person is the ultimate aim of

the platform.

FOR MORE INFORMATION LINK :

Website: https://www.vernam.com/

Telegram: https://t.me/vernam

Twitter: https://twitter.com/vernamofficial

Author : Endanglex

https://bitcointalk.org/index.php?action=profile;u=1743568

My ETH : 0x77FA8d2cC97975349F63E0ed1d4372B9865702A9

https://bitcointalk.org/index.php?action=profile;u=1743568

My ETH : 0x77FA8d2cC97975349F63E0ed1d4372B9865702A9

Komentar

Posting Komentar